Abu Dhabi Municipalities reveal real estate transactions in 2019 hit AED 58B

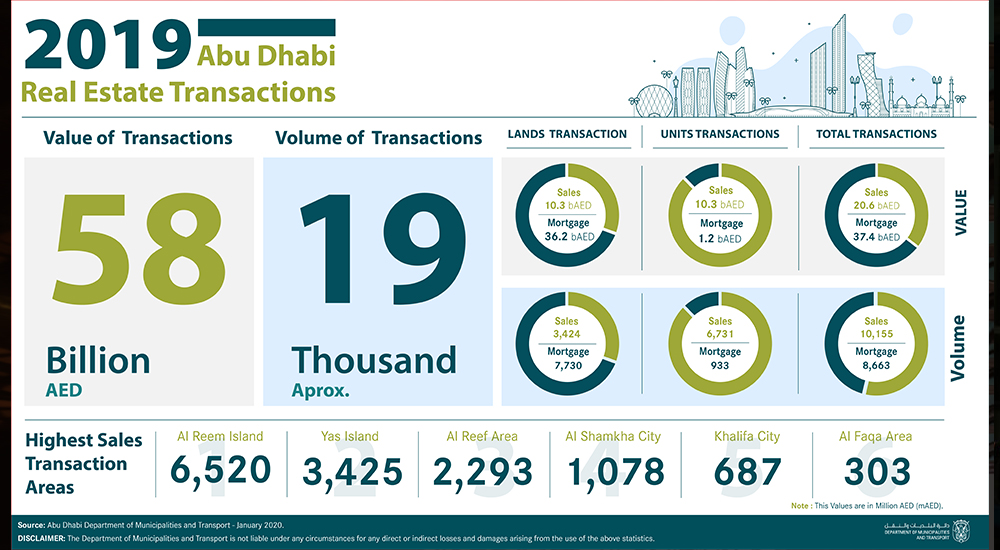

The Department of Municipalities and Transport, DMT, in Abu Dhabi announced that the total value of real estate transactions in Abu Dhabi during 2019 reached AED 58 billion as 19,000 transactions were completed. The transactions included sales and mortgages of lands, buildings and real estate units.

A report issued by DMT on the indicators of annual real estate transactions in the emirate showed that the total real estate transactions amounted to AED 20.6 billion through 10,155 transactions whereas the mortgage value reached AED 37.4 billion through 8,663 transactions.

Real estate sales varied between lands, buildings and units. Lands and buildings registered 50% of total sales, which is AED 10.3 billion through 3,424 transactions. The real estate units was 50% as a result of AED 10.3 billion sales through 6,731 transactions. The value of mortgages during 2019 reached AED 37.4 billion through 8,663 mortgage transactions, while lands and buildings acquired the vast majority of those mortgages with a value of AED 36.2 billion, 96.8% of the total. The real estate units in the total value of mortgages was 3.2%, recording AED 1.2 billion through 933 transactions.

The real estate units was 50% as a result of AED 10.3 billion sales through 6,731 transactions. The value of mortgages during 2019 reached AED 37.4 billion through 8,663 mortgage transactions.

HE Hamad Al Mutawa, Executive Director of Operations Affairs at DMT, stated that the positive performance of the real estate sector during 2019 indicates of the increasing demand for real estate by investors who are looking for a safe, stable and encouraging investment environment. The number of real estate deals was a result of the appropriate payment plans, offers and various facilities offered by several developers along with the low interest rates offered by mortgage loan providers from banks and financing institutions.

Al Mutawa stressed that because of the wise leadership’s interest in supporting the economic development and the investment environment in the emirate, the competitiveness of the local economy has increased and reflected the real estate market positively. For example, the Abu Dhabi Developmental Accelerator’s Programme Ghadan 21, allowing foreign investors to own freeholds in Abu Dhabi, in addition to amending the laws and legislations for long-term residence visas and residence visas for real estate buyers. Al Mutawa said that because of these initiatives and other related procedures and decisions, Abu Dhabi became an attractive investment environment.

Al Mutawa assured that the real estate sector is a significant factor in the local economy as it affects its competitiveness and attracts local and foreign capital. It also supports DMT’s efforts to improve the quality of life in the emirate.

Most active areas

Al Reem Island topped the list of real estate transactions with a value of AED 6.52 billion, followed by Yas Island with AED 3.425 billion. Al Reef came in third place with AED 2.293 billion. Al Shamkha ranked fourth with a total value reached AED 1.078 billion, then Khalifa City with AED 687 million and Al-Faqa came in sixth place with AED 303 million.

Al Reem Island topped the list of real estate transactions with a value of AED 6.52 billion, followed by Yas Island with AED 3.425 billion.

It is worth to mention that the annual report issued by DMT on the performance of the real estate market in the emirate represents its commitment to transparency and sharing of data and statistics that help investors and those interested in real estate in the decision-making process, and support the efforts dedicated to achieve a comprehensive and sustainable development in the Emirate of Abu Dhabi.