How Rio Tinto is adding consumer trust and sustainability to global mining

Mines and metal products are all around us. Our homes, cars, cell phones, planes, everything we have, have some link or origination from commodities. The pandemic created economic and social disruptions, but the demand and expectation for sustainability from customers and consumers has remained the same.

While industry fragmentation can slow down the cycles of innovation, a well-connected value chain, positions commodities better versus high carbon alternatives.

“Today, consumers want to know where products are coming from; what they use; what are the ingredients and whether they are responsibly sourced; and more than ever, they are prepared to vote with their wallets,” explains Paramita Das, General Manager, Global Marketing and Development, Rio Tinto. In response, global companies have been setting ambitious targets to cut global emissions and enhance their sustainability credentials.

The Rio Tinto Group is an Anglo-Australian multinational and the world’s second-largest metals and mining corporation, producing iron ore, copper, diamonds, gold and uranium. Rio Tinto has announced it will bring forward its 2030 target of reducing Scope 1 and 2 emissions by 15% to 2025, and trebling its 2030 target, increasing it to a 50% reduction of Scope 1 and 2 emissions. Rio Tinto is also committing direct investments of $7.5 billion in decarbonisation from 2022 to 2030.

“Rio Tinto’s efforts to decarbonise are unique as we are not in fossil fuel extraction and we have extensive hydropower for energy intensive businesses such as aluminium smelters,” continues Paramita.

Rio Tinto will accelerate decarbonisation by switching to renewable power, electrifying processing and running electric mobile fleets. Secondly, it will increase investment in research to speed up the development of technologies that will enable customers to decarbonise. Thirdly, it will prioritise growth capital in commodities that are essential for the drive to net zero, such as copper, battery materials and high-quality iron ore.

As an indication of the importance of sustainability, ESG funds, have captured approximately $50+ billion of net new money from investors in 2020, which has more than doubled from 2019 efforts.

Trends within industries

There is also sustainability reporting by industrial players, which is now mandatory for large companies in many countries, as well as the list of regulations deployed by governments. The automotive sector has also been under the sustainability spotlight and the industry is playing its role in an effort to reduce global emissions. This industry is major customer for almost all commodities.

“As upstream and midstream suppliers, we must do our part to contribute to the sector’s sustainability journey. We are working on recycling and we are working with and evaluating solar, wind, hydrogen and cutting-edge technologies to help us decarbonise our own operations, and we are taking it to our customers,” explains Paramita.

However, OEMS are adopting sustainability initiatives much faster than their suppliers and also moving to high priority areas, including sustainable manufacturing and supporting and promoting a circular economy. Rio Tinto is working towards becoming part of the solution.

Paramita indicates each player needs to work on their Scope 1 and Scope 2 emissions, “and sustainability is a team sport,” she says. “Multi-commodity partnerships are absolutely required to solve for ESG especially if we want to meet those stated zero emissions targets. We say, our Scope 3 could be your Scope 1 or 2, and vice versa.”

Blockchain labelling

Rio Tinto uses numerous IT applications to manage business and data processes. To provide rigorous transparency to its global aluminium customers, Rio Tinto uses digital solutions like blockchain to provide provenance tracking, helping demonstrate to authorities that its supply chain has met regulatory requirements and has satisfied conditions to attain incentives or industrial certification.

Usage of digital sustainability labels provides key information about the site where the aluminium was responsibly produced, covering multiple ESG criteria including:

- carbon footprint

- water use

- recycled content

- energy sources

- community investment

- safety performance

- diversity in leadership

- business integrity

- regulatory compliance

- transparency

This is especially critical in the world of United States-Mexico-Canada Agreement, rules of origin or Carbon Border Adjustment Mechanisms.

Recently, Rio Tinto and Schneider Electric signed an MoU for collaboration to develop a circular, sustainable marketing ecosystem for both companies and its customers.

Creation of START

Rio Tinto has launched its data driven digital solutions to helps its ecosystem and community stay on track with traceability and tracking of progress. One of the initiatives is START, which is the short form for sustainability, traceability assurance, and uses a blockchain platform.

“It is our role to bring radical transparency to our supply chain efforts around ESG progress. And all of this is brought to the market on blockchain technology,” says Paramita. The usage of blockchain is meant to instil trust in supply chain data provided by Rio Tinto and to boost its usage.

Rio Tinto’s launch of START is meant to play the same role as labels on packaging. “Think about the nutrition label on the back of almost all food products. START does exactly the same for the aluminium industry,” she explains. It is giving choice and thus building a more sustainable supply chain.

START will help Rio Tinto’s customers meet the demand from its consumers for transparency on how and where the products they purchase are made. Data can then be used to make material choices and supplier choice.

“Digital solutions allow us to communicate to consumers who are the ultimate decision makers in simple and sustainable form and digital allows us to tell our narrative in a much more powerful manner,” adds Paramita.

Using the information provide by START, customers can measure and track the carbon footprint they have generated across their supply chain all the way to the end products. The usage of digital solutions like blockchain helps with problem tracking and helps to demonstrate to authorities that a supply chain has met regulatory requirements.

“The high level of interest in START corroborates that sustainability is a team sport. We need like-minded partners to come together and work together. As they say the whole is greater than the sum of its parts,” sums up Paramita.

Key takeaways

- Rio Tinto has announced it will bring forward its 2030 target of reducing Scope 1 and 2 emissions by 15% to 2025.

- Consumers want to know where products are coming from; what they use; what are the ingredients and whether they are responsibly sourced.

- Rio Tinto will accelerate decarbonisation by switching to renewable power, electrifying processing and running electric mobile fleets.

- OEMS are adopting sustainability initiatives much faster than their suppliers and also moving to high priority areas.

- Each player needs to work on their Scope 1 and Scope 2 emissions and sustainability is a team sport.

- Multi-commodity partnerships are absolutely required to solve for ESG especially if we want to meet those stated zero emissions targets.

- To provide rigorous transparency to its global aluminium customers, Rio Tinto uses digital solutions like blockchain.

- Rio Tinto has launched its data driven digital solutions to helps its ecosystem stay on track with traceability and tracking of progress.

- Rio Tinto’s launch of START is meant to play the same role as labels on packaging.

- START will help Rio Tinto’s customers meet the demand from its consumers for transparency.

- Data can be used to make material choices and supplier choice.

- Using the information provide by START, customers can measure and track the carbon footprint they have generated.

- Usage of digital solutions like blockchain helps helps to demonstrate to authorities that a supply chain has met regulatory requirements.

Martin Provencher, Industry Principal, Mining, Metals and Materials, AVEVA.

Mining and metal companies are under lots of pressure. They have to take into consideration the sustainability aspect of their business the same way as the aspect of safety in the past ten years. Sustainability refers to the execution of business activities in a way that minimises the utilisation and consumption of resources and also minimises the impact on the natural environment.

According to IDC, companies with an ongoing sustainability strategy combined with a long-term digital transformation agenda, outperform their competitors in terms of revenue growth and profitability. Also, 27% of mining and metal organisations, identify the need to improve brand equity as a top driver for sustainability, compared with the overall industry average of 18%.

“Industrial operators need to balance safety, on-time performance, compliance and capacity in an ever-changing landscape. And to do this knowledge workers need better tools to gain insights. That is what we call operational excellence,” says Martin Provencher, Industry Principal, Mining, Metals and Materials, AVEVA.

According to Provencher, AVEVA’s three-step approach is an important piece of the technology roadmap and should be the first step towards successful digital transformation journey for sustainable mining.

AVEVA’s three-step approach to sustainable mining includes:

#1 Usage of optimising technologies such as smart engineering solutions, IoT, cloud, asset performance, analytics, AI, to meet production targets.

#2 Identifying sustainable goals and building a strategic corporate plan leading to meaningful delivery.

#3 Management of tools through a single integrated platform capable of digesting, interpreting and reporting operational data.

David Willick, Vice President North America, Mining, Minerals and Metals Segment, Schneider Electric.

When you look at electric vehicles, they require about six times more mined elements than internal combustion engines. There is three times more copper used in an electric vehicle than a traditional vehicle, 14 times more Nickel, nine times more Lithium. When you look at renewable energy, wind turbines and solar panels, all require more mined elements. 40 mined elements are part of every single one of our smartphones.

When you look at a decarbonised world, it needs more mining. A recent statistic is, in the next 25 years, the global copper production has to equal about the same amount as what was mined in the last 5,000 years. A significant increase in mine elements is required for all of them.

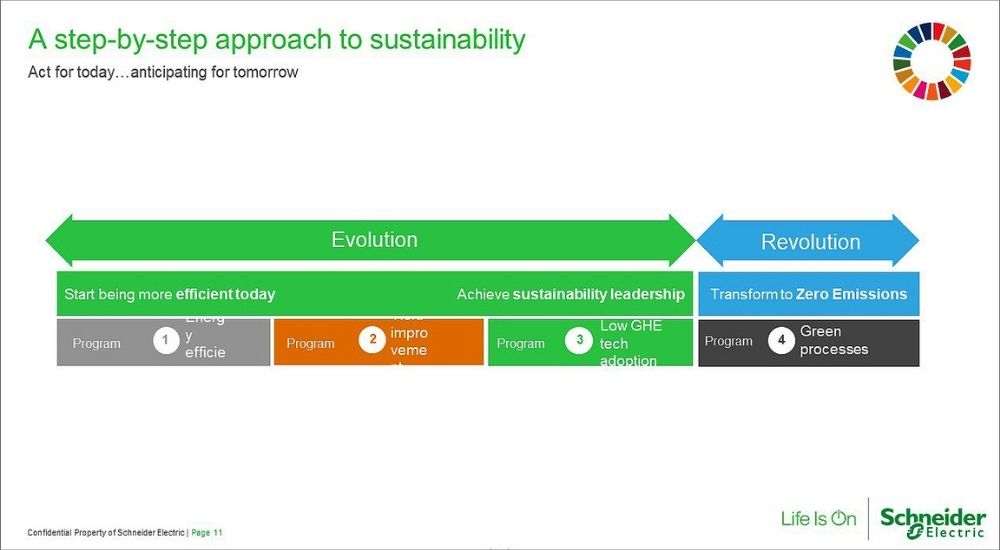

Responsible material transition has to be scaled up just as ambitiously as the renewable energy transition. And there are two ways of doing this. The evolution approach is a step wise approach towards improvement, while the revolution approach is a change from traditional methods to green methods.

Ben Kirkwood, Senior Research Manager, IDC Energy Insights – WW Mining

IDC findings show that 71% of mining, metals and mineral organisations have formal, executive sponsored sustainable initiatives in place. This shows that support for sustainability comes from the top. Another finding by IDC is that the top focus for mining organisations throughout 2021 has also been sustainability.

Such organisations are rapidly understanding that having sustainable initiatives in place, improves brand equity and helps them with compliance regulations. The bonus structures of executives from major mining, metals and mineral organisations, are also tied to sustainable key performance indicators. Organisations are also rapidly turning to technology to assist them.

The world’s second largest metals and mining group is using blockchain to label its products providing trust to its customers around sustainable data.