Are you ready for these transformation disruptions

Gartner executives offer a glimpse into global and regional, opportunities and challenges, in the area of CEO functioning, government, organisational culture, digital twins, AI, cloud, and others.

CEOs have switched their focus back to tactical performance as clouds gather on the horizon

Mark Raskino, Vice President and Distinguished Analyst at Gartner

These findings demonstrate that leadership has become more comfortable with cloud delivery models and moved away from concerns

Cathleen Blanton, Research Vice President at Gartner

A partnership with the Chief HR officers is the perfect way to align technology selections and design processes

Elise Olding, Research Vice President at Gartner

Results especially when compared with past surveys, show that digital twins are slowly entering mainstream use

Benoit Lheureux, Research Vice President at Gartner

Artificial intelligence is going to revolutionise how programme and portfolio management leverage technology

Daniel Stang, Research Vice President at Gartner

In 2019, businesses in MENA are set to increase their IT spending in all segments except for the devices segment

John Lovelock, Distinguished Research Vice President at Gartner

The shift of enterprise IT spending to cloud-based alternatives is relentless, although it is occurring over many years

Michael Warrilow, Research Vice President at Gartner

We saw the start of a rebound in PC shipments in mid-2018, but disruption by CPU shortages impacted all PC markets

Mikako Kitagawa, Senior Principal Analyst at Gartner

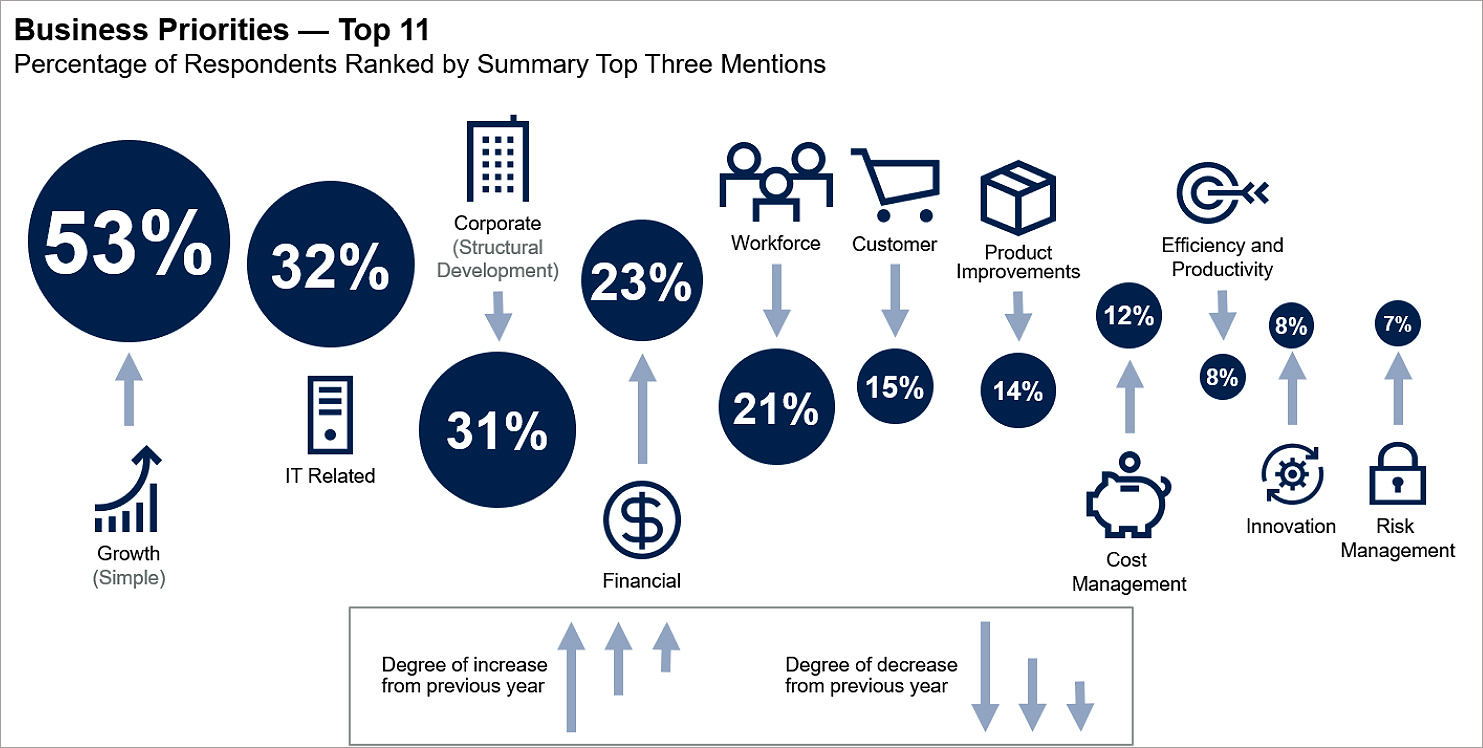

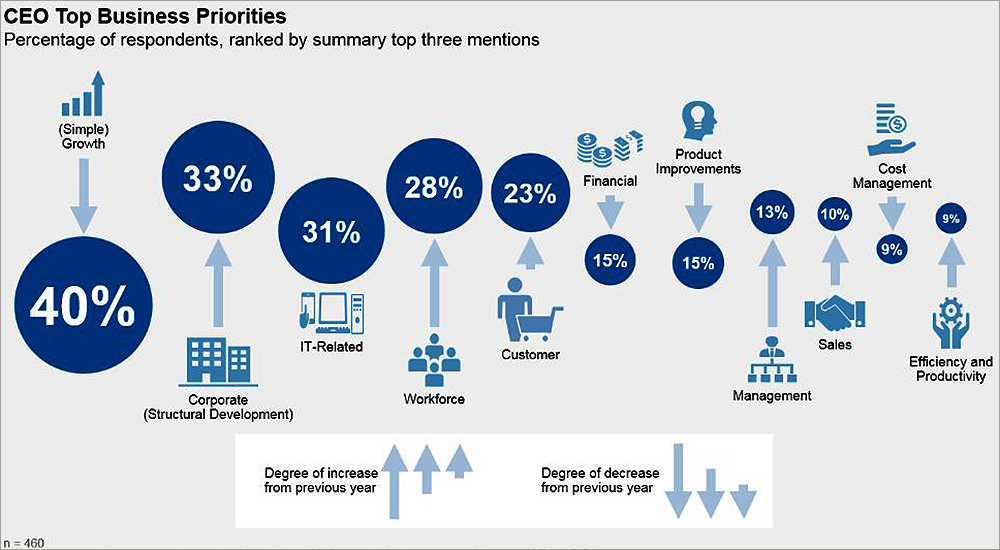

How to grow, continues to plague 53% global CEOs, Gartner executive survey

Growth continues to top the list of CEO business priorities in 2019 and 2020, according to a recent survey of CEOs and senior executives by Gartner. The most notable change in comparison to last year’s results is that a growing number of CEOs also deem financial priorities important, especially profitability improvement.

The annual Gartner 2019 CEO and Senior Business Executive Survey of 473 CEO and senior business executives in the fourth quarter of 2018 examined their business issues, as well as some areas of technology agenda impact. In total, 473 business leaders of companies with $50 million or more and 60% with $1 billion or more in annual revenue were qualified and surveyed.

“After a significant fall last year, mentions of growth increased this year to 53%, up from 40% in 2018,” said Mark Raskino, Vice President and Distinguished Analyst at Gartner. “This suggests that CEOs have switched their focus back to tactical performance as clouds gather on the horizon.”

At the same time, mentions of financial priorities, cost and risk management also increased. “However, we did not see CEOs intending to significantly cut costs in various business areas. They are aware of the rising economic challenges and proceeding with more caution — they are not preparing for recession,” said Raskino.

The survey results showed that a popular solution when growth is challenged is to look in other geographic locations for growth. Responses mentioned other cities, states, countries and regions, as well as new markets would also include some geographic reach though a new market can also be industry-related, or virtual.

It is natural to use location hunting for growth when traditional and home markets are saturated or fading. However, this year the international part of such reach is complicated and compounded by a shift in the geopolitical landscape. 23% of CEOs see significant impacts to their own businesses arising from recent developments in tariffs, quotas and other forms of trade controls. Another 58% of CEOs have general concerns about this issue, suggesting that more CEOs anticipate it might impact their businesses in future.

Another way that CEOs seem to be confronting softening growth prospects and weakening margins is to seek diversification, which increasingly means the application of digital business to offer new products and revenue-producing channels. 82% of respondents agreed that they had a management initiative or transformation programme underway to make their companies more digital, up from 62% in 2018.

Key takeaways

- 23% CEOs see impact to business from trade controls.

- Cost management has risen in CEO priorities, from #10 in 2018 to #8 today.

- CEOs think sales, risk, supply chain and HR officers are most in need of more digital savvy.

- After a significant fall last year, mentions of growth increased this year to 53%, up from 40% in 2018

- 23% CEOs see significant impacts to own businesses arising from developments in trade controls.

- 58% CEOs have concerns about this issue, anticipating it might impact their businesses in future.

- 82% agreed they had a transformation programme underway to make companies more digital, up from 62% in 2018.

Most new government solutions will be supported using XaaS model by 2023

The recent Gartner CIO survey shows that the transition to digital government is gaining momentum. It found that 53% of digital initiatives in government organisations have moved from the design stage to early stages of delivering digitally driven outcomes. This is up from 40% last year. Additionally, 39% of governments expect cloud services to be a technology area where they will spend the greatest amount of new or additional funding in 2019.

“These findings demonstrate that leadership has become more comfortable with cloud delivery models and has moved away from concerns regarding security and data ownership,” said Cathleen Blanton, Research Vice President at Gartner.

The move to digital business means that the IT organisation needs to adapt to new skills requirements. In many governments, roles of chief data officers and cloud architects are already present. However, it is worth noting that 38% of government respondents did not introduce any new roles in 2018 due to insufficient resources, skills and cultural issues. To adapt to new skill requirements, CIOs need to initiate a transformation process that results in new or changed roles.

In the future, government IT will also accomplish more diversified tasks than today. Public sector agencies will rely on government IT services to address inclusion, citizen experience and digital ethics. Those fields require new types of skillsets, such as researchers, designers and social scientists. Government CIOs must employ experts to model and explain how citizens and businesses will need to respond to regulations and policies, and what impact that will have on society, the economy and government revenues.

At the same time, government IT will need to assign new roles to support their digital transformation and introduce emerging technologies in diverse businesses and mission areas. As artificial intelligence and Internet of things technologies advance, machine trainers, conversational specialists and automation experts will slowly but certainly replace experts in legacy technologies.

Gartner predicts that by 2023, over 80% of new technology solutions adopted by governments will be delivered and supported using an anything-as-a-service, XaaS model. XaaS summarises several categories of IT, including those delivered in the cloud as a subscription-based service. It also encompasses managed desktop, help desk and network services, voice over IP and unified communications.

Key takeaways

- Gartner predicts by 2023, over 80% of new solutions adopted by governments will be delivered using XaaS model.

- Adoption of XaaS models is increasing across all industries globally, primarily driven by cloud services.

- The model offers an alternative to legacy infrastructure modernisation and investment.

- It is a promising way to scale digital government, because it can provide small local offerings as well as nation-wide services.

- The XaaS model creates new challenges for government CIOs.

- Business units may turn less to the IT department as they are now able to acquire XaaS solutions without involvement of IT.

- Departments lack knowledge to negotiate complex contracts and individual departments may be acquiring duplicative capabilities.

- As-a-service contracting is still immature and often offers weak service levels.

50% of transformational initiatives are failures and main barrier is culture

In an era of continuous change, a proactive and adaptive culture is a critical asset and CIOs will play a key role in establishing the right mindsets and practices. Gartner, predicts that by 2021, CIOs will be as responsible for culture change as chief HR officers CHROs.

“A lot of CIOs have realised that culture can be an accelerator of digital transformation and that they have the means to reinforce a desired culture through their technology choices,” said Elise Olding, Research Vice President at Gartner. “A partnership with the Chief HR officers is the perfect way to align technology selections and design processes to shape the desired work behaviors.”

The mission and values of an organisation usually fall into the remit of HR. The partnership between IT and HR can shed light on how IT can make technology and process design decisions that foster the intention of the desired organisational culture. Enterprise architecture can adopt principles that align to the cultural traits, and when business analysts design processes they can create them with the intended traits in mind. Hence, IT supports the way an organisation behaves in cooperation with HR.

However, culture change is a process. This means that there will be barriers to digital initiatives — in peoples’ mindsets and practices. A great way to jump-start culture change and enable adoption of new technologies and processes is the culture hack. Start with a small, motivated user group and use it to showcase fast wins and results.

A recent Gartner survey found that 67% of organisations have already completed culture change initiatives or were in the process of doing so. The reason for many of those initiatives was that the current culture has been identified as a barrier to digital transformation. In 50% of cases, transformational initiatives are clear failures and CIOs report that the main barrier is culture. The logical conclusion is that CIOs should start with culture change when they embark on digital transformation, not wait to address it later.

Key takeaways

- By 2021, 80% of enterprises will change culture as a way to accelerate digital transformation.

- Through 2022, 75% organisations with frontline diversity and inclusive will exceed financial targets.

- Gartner research shows that inclusion can improve performance by over 30% in diverse teams.

- There will be barriers to digital initiatives in peoples’ mindsets and practices.

- A great way to jump-start culture change and enable adoption of new processes is culture hack.

- Start with a small, motivated user group and use it to showcase fast wins and results.

Digital twin adoption slow with only 13% respondents claiming usage

13% organisations implementing Internet of Things projects already use digital twins, while 62% are either in the process of establishing digital twin use or plan to do so, according to a recent IoT implementation survey by Gartner. Gartner defines a digital twin as a software design pattern that represents a physical object with the objective of understanding the asset’s state, responding to changes, improving business operations and adding value.

“The results especially when compared with past surveys, show that digital twins are slowly entering mainstream use,” said Benoit Lheureux, Research Vice President at Gartner. “We predicted that by 2022, over two-thirds of companies that have implemented IoT will have deployed at least one digital twin in production. We might actually reach that number within a year.”

This rapid growth in adoption is due to extensive marketing and education by technology vendors, but also because digital twins are delivering business value and have become part of enterprise IoT and digital strategies.

Digital twin adoption happens in all kinds of organisations. However, manufacturers of IoT-connected products are the most progressive, as the opportunity to differentiate their product and establish new service and revenue streams is a clear business driver.

A key factor for enterprises implementing IoT is that their digital twins serve different constituencies inside and outside the enterprise. 54% of respondents reported that while most of their digital twins serve only one constituency, sometimes their digital twins served multiple; nearly a third stated that either most or all their digital twins served multiple constituencies. For example, the constituencies of a connected car digital twin can include the manufacturer, a customer service provider and the insurance company, each with a need for different IoT data.

When an organisation has multiple digital twins deployed, it might make sense to integrate them. For example, in a power plant with IoT-connected industrial valves, pumps and generators, there is a role for digital twins for each piece of equipment, as well as a composite digital twin, which aggregates IoT data across the equipment to analyse overall operations.

Despite this setup being very complex, 61% of companies that have implemented digital twins have already integrated at least one pair of digital twins with each other, and even more 74% of organisations that have not yet integrated digital twins, will do so in the next five years. However, this result also means that 39% of respondents have not yet integrated any digital twins; of those, 26% still do not plan to do so in five years.

Key takeaways

- Gartner defines a digital twin as a software design pattern that represents a physical object.

- Objective of digital twin is to understand asset state, changes, operations, adding value.

- 54% say most of their digital twins serve only one constituency, sometimes digital twins served multiple.

- 39% of respondents have not yet integrated digital twins, 26% still do not plan to do so in five years.

- Digital twins are deployed in conjunction with other digital twins for related assets or equipment.

- True integration is still complicated and requires high-order integration and information management skills.

- The ability integrate digital twins with each other will be a differentiating factor in the future.

Vendors focused on AI will disrupt portfolio management market by 2023

By 2030, 80% of the work of today’s project management discipline will be eliminated as artificial intelligence takes on traditional project management functions such as data collection, tracking and reporting, according to Gartner. “Artificial intelligence is going to revolutionise how programme and portfolio management leaders leverage technology to support their business goals,” said Daniel Stang, Research Vice President at Gartner. “Right now, the tools available to them do not meet the requirements of digital business.”

Providers in today’s programme and portfolio management software market are behind in enabling a fully digital programme management office, but Gartner predicts artificial intelligence-enabled programme and portfolio management will begin to surface in the market sometime this year.

Data collection, analysis and reporting are a large proportion of the programme and portfolio management discipline. Artificial intelligence will improve the outcomes of these tasks, including the ability to analyse data faster than humans and using those results to improve overall performance. As these standard tasks start to get replaced, programme and portfolio management leaders will look to staff their teams with those who can manage the demands of artificial intelligence and smart machines as new stakeholders.

Using conversational artificial intelligence and chatbots, programme and portfolio management and programme management office leaders can begin to use their voices to query a programme and portfolio management software system and issue commands, rather than using their keyboard and mouse. As artificial intelligence begins to take root in the programme and portfolio management software market, those programme management office that choose to embrace the technology will see a reduction in the occurrence of unforeseen project issues and risks associated with human error.

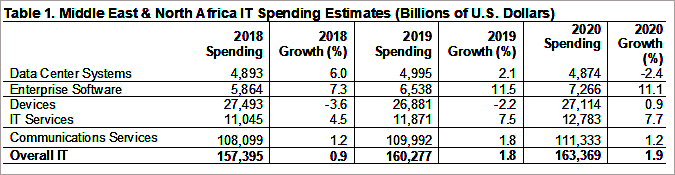

Banking top spender, transport, education, trade, weak MENA IT 2019 spenders

Middle East and North Africa IT spending is projected to reach $160 billion in 2019, a 1.8% increase from 2018, according to the latest forecast by Gartner. “In 2019, businesses in MENA are set to increase their IT spending in all segments except for the devices segment,” said John Lovelock, Distinguished Research Vice President at Gartner.

The banking and securities industry are projected to total $13.2 billion in 2019, the largest IT spending among 11 industries. It will also exhibit the fastest growth rate at 5% year over year. Banks in MENA must keep investing in IT in order to participate in the international banking system. The transportation, education and wholesale trade sectors are on pace to achieve growth of 1.0%, 2.4% and 2.8% this year respectively, and are set to be the three industries achieving the weakest IT spending growth rates in 2019.

In the enterprise sector, organisations are increasing their spending on software, which continues to be the fastest growing sector in 2019. Nevertheless, despite the rapid growth of software as a service in the region 25.8% in 2019, the region is below the global average for the percentage of total cloud spending. The MENA region is not expected to reach the level of cloud usage that the United States had in 2017 until the end of 2022.

Software and IT services are projected to exhibit the strongest growth in 2019, with an 11.5% and 7.5% increase year over year respectively. Most organisations in the MENA region are paying off years of technology deficits, and implementing software systems that standardise and automate existing business processes. Only a few leading local organisations are overcoming technology hurdles, and moving more quickly toward artificial intelligence and digital business systems, and participation in digital business ecosystems.

Consumer spending in MENA has reached a tipping point. Consumers are on pace to spend $532 million on upgrading or replacing their mobile phones in 2019, and expect to spend $63.7 billion on mobile services in 2019, up $1 billion from 2018.

Key takeaways

- Consumer spending in MENA has reached a tipping point.

- The devices market is projected to exhibit a decline of 2.2% in 2019.

- While coverage continues to expand, sales of mobile phones have stalled or declined in some countries.

- The banking and securities industry have the largest IT spending among 11 industries and fastest growth rate.

- Transportation, education, trade is set to be three industries achieving weakest IT spending growth rates.

Survival of vendors depends on capturing $1.3 Trillion cloud shift opportunity

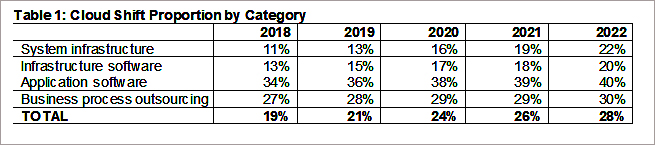

28% of spending within key enterprise IT markets will shift to the cloud by 2022, up from 19% in 2018, according to Gartner. Growth in enterprise IT spending on cloud-based offerings will be faster than growth in traditional, non-cloud IT offerings. Despite this growth, traditional offerings will still constitute 72% of the addressable revenue for enterprise IT markets in 2022, according to Gartner forecasts.

“The shift of enterprise IT spending to new, cloud-based alternatives is relentless, although it is occurring over the course of many years due to the nature of traditional enterprise IT,” said Michael Warrilow, Research Vice President at Gartner. Cloud shift highlights the appeal of greater flexibility and agility, which is perceived as a benefit of on-demand capacity and pay-as-you-go pricing in cloud.

More than $1.3 trillion in IT spending will be directly or indirectly affected by the shift to cloud by 2022, according to Gartner. Providers that are able to capture this growth will drive long-term success through the next decade. Gartner recommends that technology providers use cloud shift as a measure of market opportunity. They should assess growth rates and addressable market size opportunities in each of the four cloud shift categories: system infrastructure, infrastructure software, application software and business process outsourcing.

By 2022, almost one-half of the addressable revenue will be in system infrastructure and infrastructure software, according to Gartner. System infrastructure will be the market segment that will shift the fastest between now and 2022 as current assets reach renewal status. Moreover, it currently represents the market with the least amount of cloud shift. This is due to prior investments in data center hardware, virtualisation and data center operating system software and IT services, which are often considered costly and inflexible.

The shift to cloud until the end of 2022 represents a critical period for traditional infrastructure providers, as competitors benefit from increasing cloud-driven disruption and spending triggers based on infrastructure asset expiration. As cloud becomes increasingly mainstream, it will influence even greater portions of enterprise IT decisions, particularly in system infrastructure as increasing tension becomes apparent between on- and off-premises solutions.

Key takeaways

- Shift to cloud until the end of 2022 represents a critical period for traditional infrastructure providers.

- Competitors benefit from increasing cloud-driven disruption and spending triggers based on infrastructure asset expiration.

- As cloud becomes mainstream, it will influence even greater portions of enterprise IT decisions.

- Inside system infrastructure, increasing tension becomes apparent between on- and off-premises solutions.

- The largest cloud shift prior to 2018 occurred in application software, driven by customer relationship management.

Sluggish business sentiment pulls down global PC sales in Q1 20019

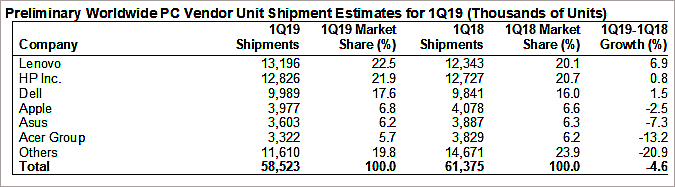

Worldwide PC shipments totaled 58.5 million units in the first quarter of 2019, a 4.6% decline from the first quarter of 2018, according to preliminary results by Gartner. “We saw the start of a rebound in PC shipments in mid-2018, but anticipation of a disruption by CPU shortages impacted all PC markets as vendors allocated to the higher-margin business and Chromebook segment,” said Mikako Kitagawa, Senior Principal Analyst at Gartner.

While the consumer market remained weak, the mix of product availability may have also hindered demand. In contrast, Chromebook shipments increased by double digits compared with the first quarter of 2018, despite the shortage of entry-level CPUs. Including Chromebook shipments, the total worldwide PC market decline would have been 3.5% in the first quarter of 2019.

The supply constraints affected the vendor competitive landscape as leading vendors had better allocation of chips and also began sourcing alternative CPUs from AMD. The top three vendors worldwide were still able to increase shipments despite the supply constraint by focusing on their high-end products and taking share from small vendors that struggled to secure CPUs.

Moreover, the constraints resulted in the top vendors shifting their product mix to the high-end segment in order to deal with the constraint — which, along with favourable component price trends, should boost profit margins.

Business PC demand remained strong throughout the first quarter of 2019 across most key regions. The PC refresh driven by Windows 10 has been a driving force of business PC growth over the past three years, but Gartner forecasts that 2019 will be the last year in which shipments will be impacted by this refresh. While PC shipment results in the first quarter of 2019 indicated that the business PC segment still showed strong demand, weak mobile PC results could be the indicator that the Windows 10 refresh has nearly peaked.