DEX approved to operate as crypto exchange, custodian by Abu Dhabi Global Market

DEX has secured an in-principle approval from the Financial Services Regulatory Authority, as a regulated Digital Asset Exchange and Digital Asset Custodian based in the Abu Dhabi Global Market in Abu Dhabi, United Arab Emirates. DEX will provide a platform for both retail and institutional grade investors to invest through a fully regulated exchange into digital assets in a highly regulated financial eco system.

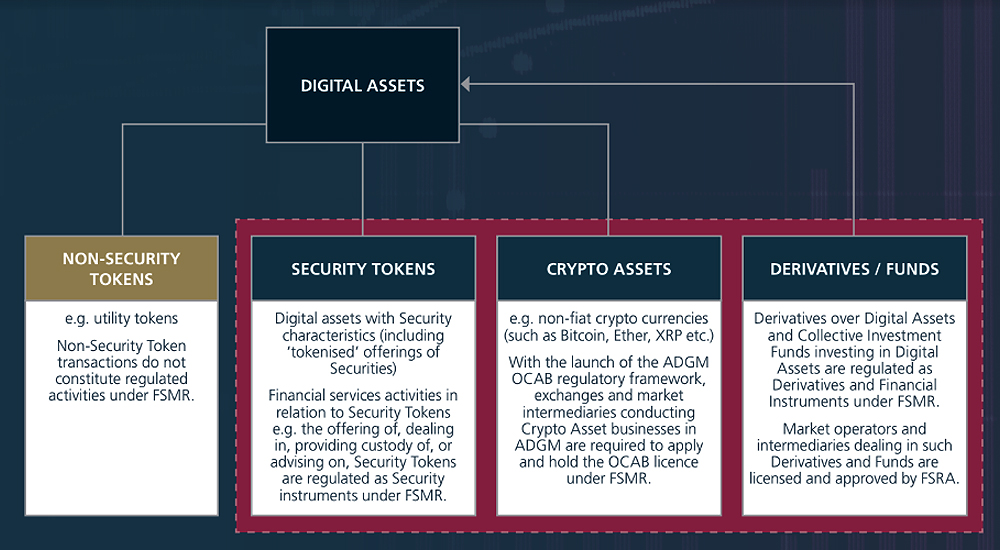

DEX will operate as a regulated Digital Asset Exchange and Digital Asset Custodian under the Operating a Crypto Asset Business framework structured by the Financial Services Regulatory Authority that oversees all crypto asset and financial services activities in the Abu Dhabi Global Market. The exchange will act as a fiat to crypto exchange with major international currencies being served as well as local currency pairings native to the UAE and GCC markets.

DEX represents a regulated crypto exchange in the UAE that will allow retail and institutional investors from the UAE, GCC and global markets to trade on a regulated exchange as a fiat to crypto centralised exchange. DEX will offer institutional investors, high net worth individuals and crypto funds with the ability to trade on a highly regulated exchange and to hold their crypto assets on their behalf as a regulated crypto asset custodian.

The compliance, market surveillance and measures taken to regulate the exposure of BTC to nefarious sources traded on the exchange will provide the highest level of regulation available in congruence with the regulatory framework employed by the Financial Services Regulatory Authority. Moreover, with corporate tax currently set at 0% in the UAE, the exchange will benefit from reduced taxation as well as potentially attracting institutional investors whose profits may benefit from the same tax regime.

Leading financial jurisdictions such as the United States as regulated by the Securities Exchange Commission have provided guidance as to how digital assets in the form of coins, tokens or other digital assets may be treated. However, as no statutory laws have been enacted by the US Congress as federal law it has left many primary stakeholders within the digital asset eco system conducting business in the United States with little to no surety as to how the financial regulatory authorities will regulate the digital asset eco system.

The Operating a Crypto Asset Business framework backed onto the market infrastructure rules in the Abu Dhabi Global Market provides clear guidance as to how crypto assets are treated and represents an attractive regulatory framework for financial institutions to participate in that is congruent with regulatory principles that govern traditional financial markets and products.

DEX embodies first in class operational capabilities, regulatory mechanisms and is positioned to be a regulated Crypto Asset Exchange attracting both local and global institutional investment into crypto assets. Subject to regulatory approval, DEX expects to provide full operational trading services to clients in 2019 in the UAE, GCC markets and globally.

“The GCC has the potential to become a leading financial hub for crypto trading and digital assets. Regulations are being implemented. In June 2018, Abu Dhabi Global Market has launched a framework to regulate spot crypto asset activities undertaken by exchanges, custodians and other ADGM intermediaries,” says Leon Smith, Founder and CEO, DEX.

“The regulatory framework that has been enacted by the Financial Services Regulatory Authority of Abu Dhabi Global Market sets a new benchmark for the regulation of digital and crypto assets on a global scale. DEX will provide a secure platform for our clients to trade crypto assets securely in a regulated environment.”

Regulations on operating a crypto asset business

To address the global demand from industry players, the Financial Services Regulatory Authority of Abu Dhabi Global Market launched a comprehensive and regulatory framework in June 2018 for the regulation of exchanges, custodians and other intermediaries engaged in crypto asset activities. The framework sets a high watermark catering to participants who are committed to conducting their crypto asset businesses in a safe and trusted environment.

It is designed to address the full range of risks associated with crypto asset activities, including risks relating to money laundering and financial crime, consumer protection, technology governance, custody and exchange operations.

Crypto Asset means a digital representation of value that can be digitally traded and functions as: medium of exchange, unit of account, store of value, but does not have legal tender status in any jurisdiction. A Crypto Asset is neither issued nor guaranteed by any jurisdiction, and fulfils the above functions only by agreement within the community of users of the Crypto Asset; and distinguished from fiat currency and E-money.

Financial Services Regulatory Authority will only allow Operating a Crypto Asset Business licence holders to use accepted crypto assets within the Abu Dhabi Global Market. Financial Services Regulatory Authority has a general power to determine each Accepted Crypto Asset that will be permitted in relation to Operating a Crypto Asset Business activities within the Abu Dhabi Global Market.

For the purposes of determining whether a Crypto Asset meets the requirements of being an Accepted Crypto Asset, Financial Services Regulatory Authority will consider: maturity market capitalisation threshold at the time of an application; other factors that in the opinion of Financial Services Regulatory Authority, need to be taken into account in determining whether or not a particular Crypto Asset meets the requirements to be considered an accepted Crypto Asset, including:

- Security

- Traceability, monitoring

- Exchange connectivity

- Market demand, volatility

- Type of Distributed Ledger

- Innovation, efficiency

- Practical application, functionality

Business distinguishes the regulation of Crypto Asset activities from the regulation of financial instrument, specified investment related activities under the Financial Services Regulatory Authority’s existing regulatory framework. Operating a Crypto Asset Business licence holders will be issued with a single financial services permission for the purposes of Operating a Crypto Asset Business irrespective of the Crypto Asset activity that they are conducting. Two key specific activities attract higher regulatory requirements, namely:

- Operating a Crypto Asset Exchange

- Operating as a Crypto Asset Custodian