Dubai Financial Services Authority introduces Crypto Token Regime

The UAE has long positioned itself at the forefront of innovation in the region and is now strengthening its status by becoming the hub for crypto investors in the Middle East. Following the footsteps of regulators, the Dubai Financial Services Authority has published its Regulation of Crypto Tokens, the Crypto Token Regime which sets out a regulatory regime for persons seeking to provide financial services in respect of Crypto Tokens.

This regime came into force on November 1st, 2022, presenting an additional jurisdiction in the UAE in which cryptocurrency trading and exchange activities may take place.

The Crypto Token Regime aims to set guidelines that ensure investors are adequately protected while providing an advanced virtual asset ecosystem in terms of organisation, governance and security.1 Below is an overview of the main provisions introduced by this legal and regulatory framework.

Classification of Tokens

For the purposes of this regulation, the Dubai Financial Services Authority defines a Crypto Token as a token that:

#A is used, or is intended to be used, as a medium of exchange or for payment or investment purposes; or

#B confers a right or interest in another token that meets the requirements in, #A.

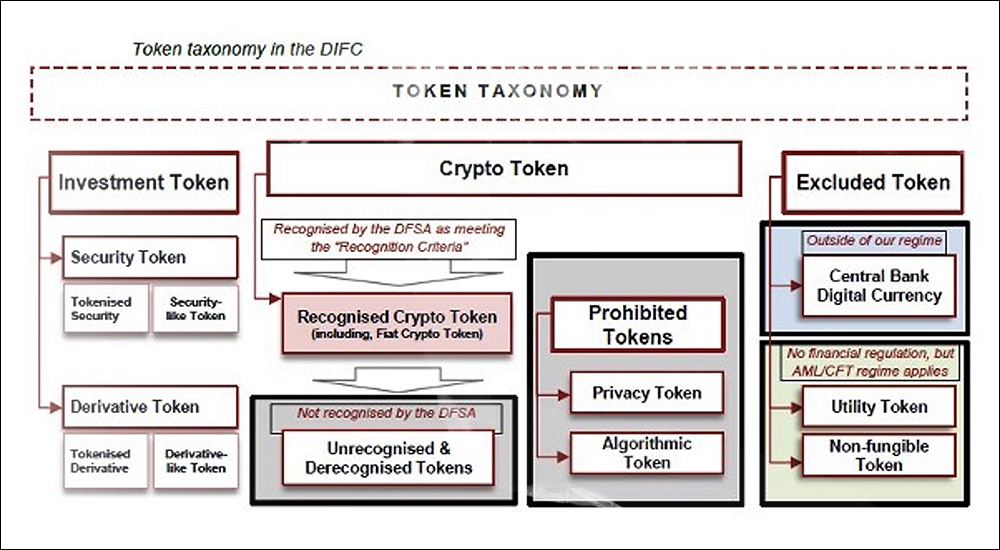

Not all types of tokens are regulated by the Crypto Token Regime. In fact, the Dubai Financial Services Authority has classified tokens into several categories:

Recognised Crypto Tokens

A Crypto Token is recognised by the Dubai Financial Services Authority if, a) it is included on the pre-recognised list of Crypto Tokens published by the Dubai Financial Services Authority or, b) it has been specifically recognised by the Dubai Financial Services Authority following a recognition application process.

The Dubai Financial Services Authority has introduced the list of pre-recognised Crypto Tokens that will not need to go through the formal recognition process to be accepted and as of today, this list includes Bitcoin BTC, Ethereum ETH and Litecoin, LTC.

This means that funds which invest in Crypto Tokens will be limited to the sale of Recognised Crypto Tokens only. While BTC and ETH remain the largest tokens in terms of market cap, we expect applications to be submitted by authorised firms or new applicants to the Dubai Financial Services Authority requesting that additional tokens be considered. This includes existing Dubai Financial Services Authority authorised firms that wish to obtain a variation of their license to include crypto tokens.

Fiat Crypto Tokens

They must undergo a recognition process as well as meet additional criteria for them to be permitted to be used in the Dubai International Financial Centre. Financial services and activities can only be carried out in relation to Fiat Crypto Tokens that are recognised.

Prohibited Tokens, Unrecognised and Derecognised Tokens

Carrying out any financial service or other activity with Prohibited Tokens, Privacy Tokens or Algorithmic Tokens, Unrecognised Tokens, Crypto Tokens not assessed by the Dubai Financial Services Authority and Derecognised Tokens, Crypto Tokens that were recognised but no longer meet the criteria is strictly prohibited.

Excluded Tokens

Non-fungible Tokens, NFT and Utility Tokens, UT are outside the scope of regulation under the Crypto Token Regime but will be required to register with the Dubai Financial Services Authority as a Designated Non-Financial Business or Profession, as well as comply with Anti Money Laundering requirements from the commencement date of the Crypto Token Regime or face potential enforcement action.

One of the deciding factors to determine whether a Token is an NFT is the unique and non-fungible nature of the Token, which must relate to, and represent, an identified asset, such as art, music, or another collectable item. The Dubai Financial Services Authority will take a substance over form approach in determining whether a certain Token is an NFT.

Recognition process

Recognition applications will be submitted to the Dubai Financial Services Authority which will issue a notice on its website in this regard. The application process is made on the Dubai Financial Services Authority website www.dfsa.ae, innovation where a General Enquiries Contact Form must be completed. The Dubai Financial Services Authority will review each application on a case-by-case basis and will not set a specified timeframe for the review as this will greatly depend on the quality of the information and analysis presented by the applicant.

Recognised jurisdictions

The Dubai Financial Services Authority may recognise another jurisdiction as having a regulatory regime for Crypto Tokens that is equivalent to that of the Dubai Financial Services Authority. A list of recognised regional and foreign jurisdictions will be published on the Dubai Financial Services Authority’s website as having an equivalent regulatory regime.

A list of recognised jurisdictions may have several practical implications for example: when considering whether an existing authorised firm, operating as a branch in the Dubai International Financial Centre should be permitted to provide certain Financial Services with Crypto Tokens without having to establish a legal entity in the Dubai International Financial Centre, the Dubai Financial Services Authority has indicated that it will look to see whether the parent institution of the branch is authorised for Crypto Token business in its home jurisdiction.

Transition period

The Dubai Financial Services Authority has introduced a six-month transition period starting 1 November 2022 for authorised firms already providing services related to Crypto Tokens to comply with the requirements of this regime. One of the consequences of this transitional arrangement is that authorised firms may continue providing that same service with Crypto Tokens for only six months.

Firms should allow sufficient time to submit their Crypto Token recognition applications and have them assessed by the Dubai Financial Services Authority before the transitional period ends, or they will be required to cease offering any products and services relating to those Tokens.

The Dubai Financial Services Authority is planning to explore other policies relating to Crypto Tokens such as Staking, Decentralised Finance activities and AML, CTF issues. In the meantime, we expect this regime to be met with considerable interest from both local and international players who will be looking to set up their Financial Services license in the Dubai International Financial Centre.

Key takeaways

- The regime came into force on November 1st, 2022, presenting a jurisdiction for cryptocurrency trading and exchange.

- The Dubai Financial Services Authority has introduced the list of pre-recognised Crypto Tokens.

- Funds which invest in Crypto Tokens will be limited to the sale of Recognised Crypto Tokens only.

- One of the deciding factors to determine whether a Token is an NFT is the unique, non-fungible nature of the Token.

- Dubai Financial Services Authority is planning to explore other policies such as Staking, Decentralised Finance, AML, CTF.