Industrial IoT creating opportunities for cybersecurity services, Frost & Sullivan

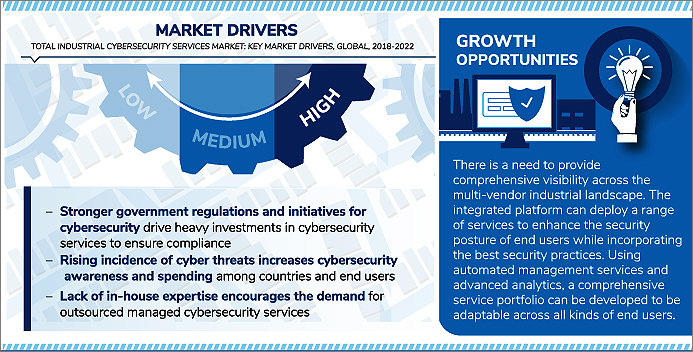

According to a recent analysis from Frost & Sullivan, cyber-attacks within the energy and utilities industries alone cost an average of $13.2 million per year. These rising incidences of cyber-attacks, coupled with evolving compliance regulations by governments, and increased awareness among mature and less mature markets have accelerated the adoption of cybersecurity approaches. However, there is still a high level of ambiguity in addressing industrial cybersecurity, with existing cybersecurity services struggling to provide comprehensive visibility across both IT and OT networks.

“The industrial cybersecurity services market is at the high growth stage of its lifecycle, with rising awareness among end users, increased industrial control systems ICS-based attacks, and the rising need for cybersecurity skills,” said Riti Newa, Industrials Research Analyst. “Many end users have labor-intensive security practices and lack strong cybersecurity policies. Service providers can help automate cybersecurity services and provide a more holistic approach by offering joint solutions that provide a consolidated view of the IT and OT environment.”

Frost & Sullivan’s recent analysis, Global Industrial Cybersecurity Services Market, Forecast to 2022, explores market adoption rates, requirements, and trends across the market. It also covers emerging service models and their usages, as well as monetisation strategies for those models.

Companies that are eager to grow within the industrial cybersecurity market can find opportunities through:

- Providing integrated platforms that can deploy a range of services to enhance the security posture of end users while incorporating the best security practices.

- Using automated management services and advanced analytics to develop a comprehensive service portfolio that can be adapted for all types of end users.

- Offering flexible pricing models, such as Cybersecurity-as-a-Service CSaaS, and lifetime services to increase accessibility across industries at a lower cost.

“Despite the growing frequency of cyber-attacks, industries still have very low cyber resilience, struggling to ensure cybersecurity in the OT environment,” said Newa. “With complexity and sophistication of the attacks, service providers will need to focus on advanced services that can address the threat landscape and automate cybersecurity.”

Global Industrial Cybersecurity Services Market, Forecast to 2022 is the latest addition to Frost & Sullivan’s Industrials research and analyses available through the Frost & Sullivan Leadership Council, which helps organisations identify a continuous flow of growth opportunities to succeed in an unpredictable future.

Table of Contents

Executive Summary

Key Findings

- Current and Future Areas of Differentiation

- Market Engineering Measurements

- CEO’s Perspective

- Talk to Experts

- Services 2.0 Framework

Market Overview

- Market Definitions

- Market Segmentation Services Type

- Market Distribution Channel

Market Segmentation

- Market Segmentation

- Industrial Cybersecurity Service Providers Market Landscape

- Major Industrial Cybersecurity Service Providers

- Market Opportunity Matrix for Industrial Cybersecurity Services

Drivers and Restraints—Total Industrial Cybersecurity Services Market

- Market Drivers

- Market Restraints

- Market Forecasts

- Market Engineering Measurements

Revenue Forecast

- Percent Revenue Forecast by Region

- Revenue Forecast by Region

- Revenue Forecast by Vertical Market

Market Share and Competitive Analysis

- Market Share Analysis

- Competitive Environment

- Competitive Analysis

- Top Competitors

- Companies to Action

Growth Opportunities and Companies to Action

- Growth Opportunity 1—Acquisition Integration Model

- Growth Opportunity 2—Coopetition: Emerging Partnership With Competitors

- Growth Opportunity 3—Subscription-based Services

- Strategic Imperatives for Service Providers

Visioning Scenarios

- Transition to Security as a Service

- Cybersecurity Platforms for Service Deployments

- Monetization of Cybersecurity as a Service

- Emerging Partnerships

Managed Security Services Segment Analysis

- Implications of Managed Security Services

- Overview of Current Managed Security Services

- Managed Security Services—Integrated Model Service Delivery

- Managed Security Services—Pricing Model Approach for Service Packages

- Managed Security Services—Pricing Model Development

- Market Engineering Measurements

- Revenue Forecast

- Market Share Analysis

Professional Services Segment Analysis

- Implications of Professional Services

- Market Engineering Measurements

- Revenue Forecast

- Market Share Analysis

- Companies to Action

The Last Word

The Last Word—3 Big Predictions

Legal Disclaimer

Appendix

- Market Engineering Methodology

- Abbreviations

- Companies Interviewed

- List of Exhibits