Why artificial intelligence is a key component of autonomous cars

The impact of artificial intelligence is being seen across industries and geographies. Artificial intelligence is now a key to success for organisations and is set to be a significant contributor towards global economic growth by 2030. According to a study by McKinsey Global Institute, on average, the global gross domestic product could increase by 1.2% per year, which would correspond to a total value added of $ 13 Trillion.

Among a number of industry segments, the automotive industry is one of the most technologically advanced and progressive industries. It is no surprise that the industry is a frontrunner in adopting and incorporating artificial intelligence into research, design, and manufacturing processes for smarter and better outcomes and products.

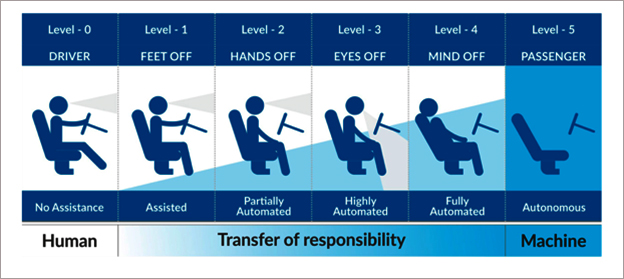

When you think about artificial intelligence in automotive, autonomous vehicles is likely the first use case that comes to mind. While the holy grail in the industry is full self-driving, defined as level 5, most companies are already offering increasingly sophisticated adaptive driver assistance systems as stepping stones towards that level of autonomy.

In an industry like automotive, the number of possible artificial intelligence use cases is large and essentially divided into four segments which are autonomous driving, connected vehicles, mobility as a service, and smart manufacturing. Naturally, there are overlaps between some of these segments; success in one area can yield benefits in another.

For example, autonomous driving may be a key element of a mobility-as-a-service strategy. There are also many requirements that all segments have in common, including infrastructure integration, advanced data management, security, privacy, and compliance.

There are, however, challenges to achieving full self-driving. Each car deployed for research generates a mountain of data; 1TB per hour per car is typical. Teams can expect to accumulate hundreds of Petabytes to Exabytes of data as autonomous driving projects progress.

This raises several critical questions such as how to create a pipeline to move data efficiently from vehicles to train a neural network or how to efficiently prepare and label data for neural network training.

Some questions that need to be addressed are how much storage and compute power is needed to train a neural network, to run inference on a trained neural network and if the training cluster should be on-premises or in the cloud. It is also important to determine how to correctly size the infrastructure for data pipelines and training clusters including storage needs, network bandwidth, and compute capacity.

Cars and other vehicles are quickly transforming into connected devices, and there are a number of immediate use cases for artificial intelligence in connected cars such as personal assistants, voice-activated operations, telematics and predictive maintenance, infotainment and recommenders.

Today, cars use cellular and WiFi connections to upload and download entertainment, navigation, and operational data. In the near future, we will also see cars connecting to each other, to our homes, and to infrastructure.

For example, Audi has already introduced technology to connect cars to stoplight infrastructure, enabling drivers in select cities to catch a green wave, timing their drives to avoid red lights. That is just one of many opportunities to use data from connected cars.

In the future, car ownership may decline in favor of various forms of ride sharing, particularly in dense urban areas. Car companies will need to become mobility service companies to address changing consumer demand. Many car companies such as Ford and home-grown Careem are already branching out, acquiring scooter and bike-sharing companies and creating delivery services.

The machine learning and deep learning problems in mobility-as-a-service models are significantly different than those in autonomous driving:

- How do you predict customer demand?

- How do you optimise fleet efficiency and minimise customer wait times?

- How do you dynamically set prices in response to demand?

- How do you ensure passenger physical security?

- How do you protect customer data, prevent fraud, and balance privacy versus convenience?

From an infrastructure standpoint, these distributed problems require different strategies and may require smart algorithms on the consumer’s device smart phone, in the vehicle, and in the cloud, plus long-term, secure data management for compliance.

The auto industry has a lot on its plate. Companies must look for ways to increase operational efficiency to free up capital for investments like those described above. Industrial Internet of Things and Industry 4.0 technologies are the key to streamlining business, automating and optimising manufacturing processes, and increasing the efficiency of the supply chain.

Common manufacturing use cases include an increased use of computer vision for anomaly detection, process control for improved quality and reduced waste, predictive maintenance to maximise productivity of manufacturing equipment.

Competition in the auto industry is also fierce. Leaders look to train their own artificial intelligence specialists and developers and cooperate with other companies to maintain their standing. While these measures are intended to close the current knowledge gap, it also helps achieve the goals of higher product quality, better customer experience with artificial intelligence, and reducing operating costs.

Innovations are the key to keeping up with IT companies in the competitive field of autonomous driving. The benefits that artificial intelligence brings to the automotive industry are perceived as excessive. At the same time, there is an increasing pressure on business representatives not to miss out on the next big thing.

Industry studies usually stop at a point where they become interesting: the impact on daily work routine. It would be exciting to see which artificial intelligence technology the experts in the automotive industry are working on and what challenges they face.

Key takeaways

- Each car deployed for research generates a mountain of data – 1TB per hour per car is typical.

- How do you create a pipeline to move data efficiently from vehicles to train a neural network?

- How do you efficiently prepare and label data for neural network training?

- How do you size infrastructure for data pipelines and training clusters including storage, network bandwidth, compute capacity?

- The benefits that artificial intelligence brings to the automotive industry are perceived as excessive.

- Cars use cellular and WiFi connections to upload and download entertainment, navigation, operational data.

- We will also see cars connecting to each other, to homes, and to infrastructure.

An autonomous car generates 1TB data per hour, putting enormous workloads on the network to learn from, explains Fadi Kanafani, from NetApp.