Commodity market has been buoyed by everything rally into 2021

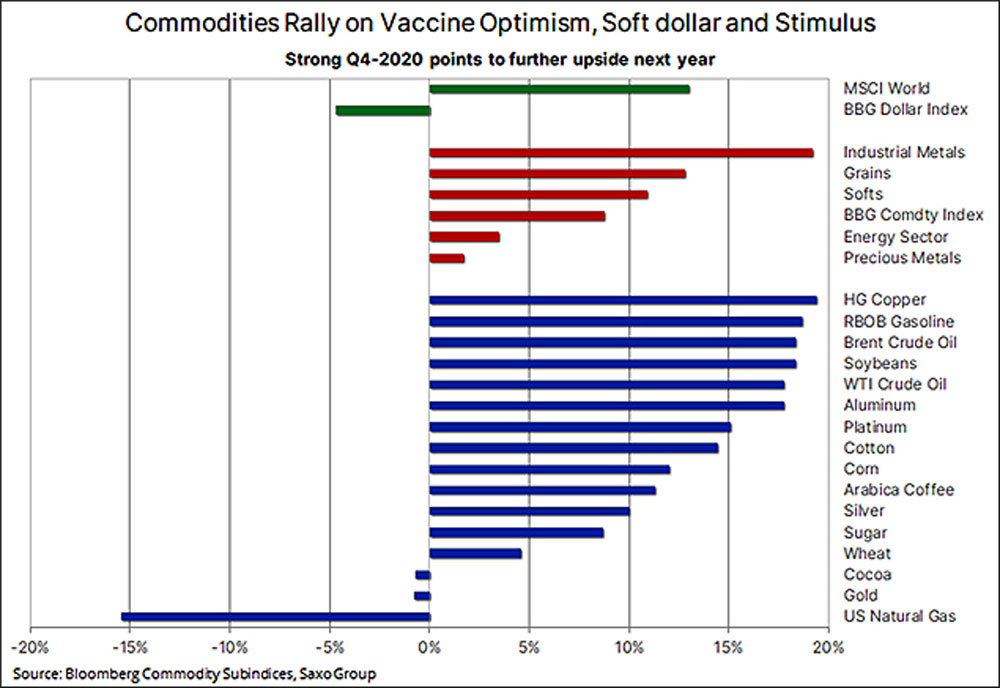

Commodity markets maintained their strong momentum ahead of year-end as the so-called everything rally continues to be fed supportive news. Apart from the weaker dollar and vaccine optimism lifting the prospects for 2021, the market is also being supported by speculation about more near-term stimulus from governments and central banks.

These developments highlight the current challenge where markets are pricing in a brighter tomorrow while the pandemic is still raging across many countries, especially in winter-hit regions across the northern hemisphere where the prospect for improvement – vaccine or not – is unlikely to occur until warmer weather arrives in March and April.

The combination of a global market flushed with cash, driving wild speculation across markets, and the potential for another super cycle in commodities led by China and its unstoppable appetite for raw materials, have seen the Bloomberg Commodity Index rise by close to 9% this quarter.

Still on track for an annual loss, mostly due to heavy losses in energy during the early stages of the pandemic, the prospect for 2021 is looking increasingly bright.

The combination of the green transformation driving demand for key industrial metals, including silver, a weaker dollar, increased demand for inflation hedges, a pickup in fuel demand as global mobility recovers and not least rising demand outside China as governments go on a spending spree to support jobs. Adding to these the risk of elevated food prices as the weather becomes more volatile.

The ongoing everything rally this past week was particularly noticeable in metals. Leading from the front we find industrial metals where HG copper topped $3.6 per lb and LME copper $8000 per T for the first time in seven years. That strength has been filtering through to semi-precious metals, with silver trading up by more than 7% on the week after breaking key technical levels, both against the dollar and against gold.

Rising demand, especially from China, looks set to remain strong in 2021 when the rest of the world emerges from the Covid-19 cloud, thereby raising concerns about available supply following years of under investments. The metals rally in 2020 has been the sharpest in a decade with Goldman Sachs seeing echoes of the spike in early 2000’s when Chinese demand started a near decade-long super cycle.

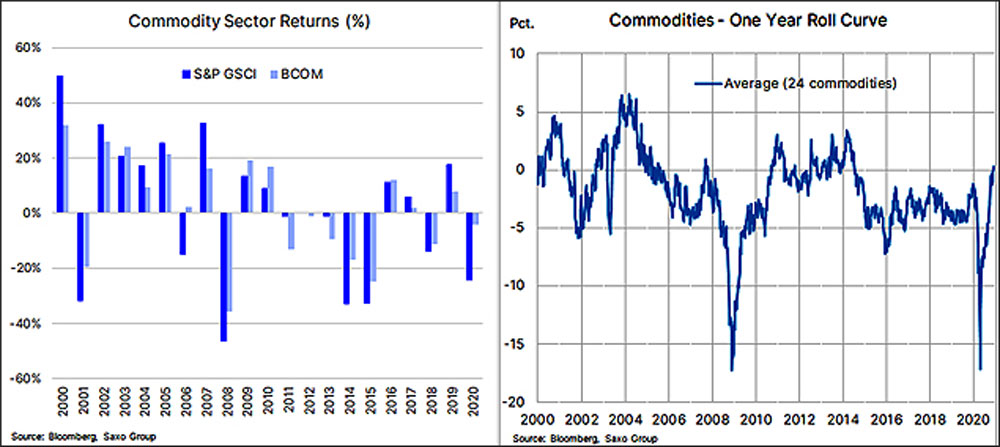

One of the main obstacles for a commodity rally during the past decade has been the ample availability of raw materials. Oversupply during the past decade and especially during the past six years kept the commodity sector as a whole in a state of contango where the spot price, due to ample availability, trades cheaper than deferred prices.

Since 2014, a portfolio of 24 major commodities carried a negative roll yield which at times was as high as five percent on an annual basis. From an investment perspective, this headwind combined with a generally strong dollar and low inflation reduced the attraction of the sector.

In recent months, however, the roll yield has turned positive with the change so far being led by the agriculture sector where key crops have rallied strongly in response to lower production and rising demand.

Looking ahead to 2021 the expected pickup in demand as well as the reflation theme look set to underpin the sector, especially markets where supply may struggle to meet demand. We are focusing on copper, platinum and soybeans to mention a few.

Nothing ever goes in a straight line, especially when it comes to commodities. And while a bullish outlook for 2021 is growing we also have to acknowledge that the rally over the past few months has been driven by a very optimistic vaccine outlook driving the dollar down and stock markets higher.

With this in mind we may have reached levels that raise a few questions as 2021 gets under way. Not least in the oil market where Brent crude oil popped above $50 per B for the first time since March. This during a period where the only bright spot is strong demand from China and India while lockdowns continue to impact fuel demand elsewhere.

In their latest oil market reports for December, OPEC, IEA and EIA all warned that the rebalancing of the global oil market may take longer than previously expected. Following a demand loss of 9.2 million barrels per day in 2020, the three forecasters now see a 5.8 million barrel per day recovery in 2021 with the IEA seeing the oil glut staying until end-2021.

Having rallied non-stop since the early November vaccine announcements, Brent crude oil has now recovered 61.8% of the January to April collapse. Given the near-term outlook for supply and demand, the rally is likely to pause with $50 per barrel being the level to gravitate around until an actual improvement in demand becomes more visible.

Key takeaways

- Rising demand, especially from China, looks set to remain strong in 2021.

- Metals rally in 2020 has been the sharpest in a decade.

- Goldman Sachs sees echoes of the spike when Chinese demand started a near decade-long super cycle in in early 2000’s.

- In the oil market, Brent crude oil popped above $50 per B for the first time since March.

- Rising demand, especially from China, looks set to remain strong in 2021.

- One of the main obstacles for a commodity rally during the past decade has been the ample availability of raw materials.

- Oversupply during the past decade and especially during the past six years kept the commodity sector as a whole in a state of contango.