How liberalisation of cinema is transforming Saudi’s entertainment market

Saudi Arabia has embarked on a new, transformational era of growth led by Vision 2030 towards economic and social development whereby leveraging the potential of non-oil sectors and subsequently improving the quality of life of its residents. In promoting culture and entertainment, one of the goals of Vision 2030, the government plans to specifically:

- Attract local investors and create partnerships with international entertainment corporations.

- Increase household spending on entertainment from 2.9% to 6% and develop a market of SAR 30 billion in recreational services.

Armed with an investment budget of SAR 10 billion, Development Investment Entertainment Company, DIEC is acting as a catalyst in the development of the cinema sector in Saudi Arabia and is projected to directly contribute SAR 1 billion to the GDP and create 1,000 direct jobs by 2020.

Lifting the 35-year ban on cinemas is one of the most visible and impactful initiatives undertaken by the government in Saudi Arabia, unlocking an untapped and lucrative economic opportunity. According to the Quality of Life Programme 2020, 45+ cinemas will be developed in Saudi Arabia by 2020.

The participation of AMC entertainment, the world’s largest cinema operator and DIEC is expected to give a boost to the development of the cinema industry in Saudi Arabia. In April 2018, DIEC opened its first cinema in the King Abdullah Financial District and aims to open 50-100 cinemas across Saudi Arabia by 2030.

The fast-paced development of the cinema sector can be demonstrated by the opening of Saudi Arabia’s second cinema by VOX Cinemas. Alongside DIEC, VOX has been an early entrant into Saudi Arabia’s cinema market and plans to invest $533M to open 600 screens across Saudi Arabia and provide 3,000 new jobs over the next 5 years to capture a share of anticipated demand. Most recently, IMAX signed a deal with VOX to partner on a minimum of 4 multiplex venues in Saudi Arabia.

Several international cinema operators are also keen to get a foothold early in Saudi Arabia’s promising cinema market and have signed MoUs with local or regional partners.

Content suitability

As a new cinema market, the type of content that appeals to audiences in Saudi Arabia is still to be established. Adam Aron, AMC’s CEO expects the same version of movies shown in Dubai or Kuwait to be suitable for Saudi Arabia.

Around one third of Saudi Arabia’s total population are expatriates, largely centered around the provinces of Riyadh and Makkah, with non-Saudis constituting 38% and 42% respectively. Saudi Arabia is home to ~3 million Indians which is the largest expatriate community in Saudi Arabia.

As a result, content screened in Saudi Arabia is expected to range from global Hollywood blockbusters to Bollywood, regional and local films. In addition, VOX cinemas, through a partnership with 20th century Fox, will exclusively distribute Fox content in Saudi Arabia.

The cinema industry will also work to conserve and promote national heritage and talent by screening movies produced by local producers and will work towards exporting local content internationally. One of the Quality of Life Programme metrics’ is to develop the local film industry with the goal of producing 13 Saudi movies by 2020.

With Saudi Arabia’s population forecast to be 39.5 million by 2030, Saudi Arabia has the potential to absorb up to 2,600 screens.

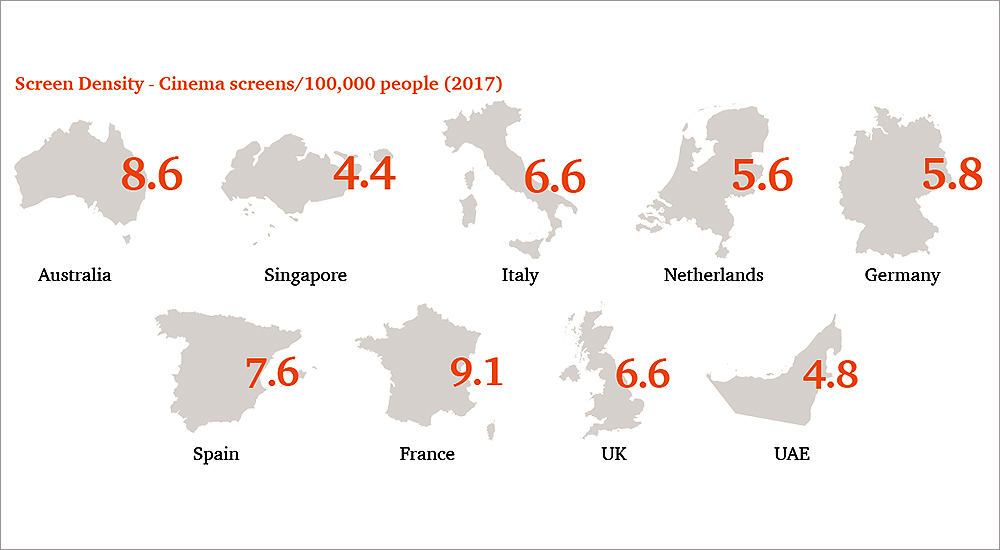

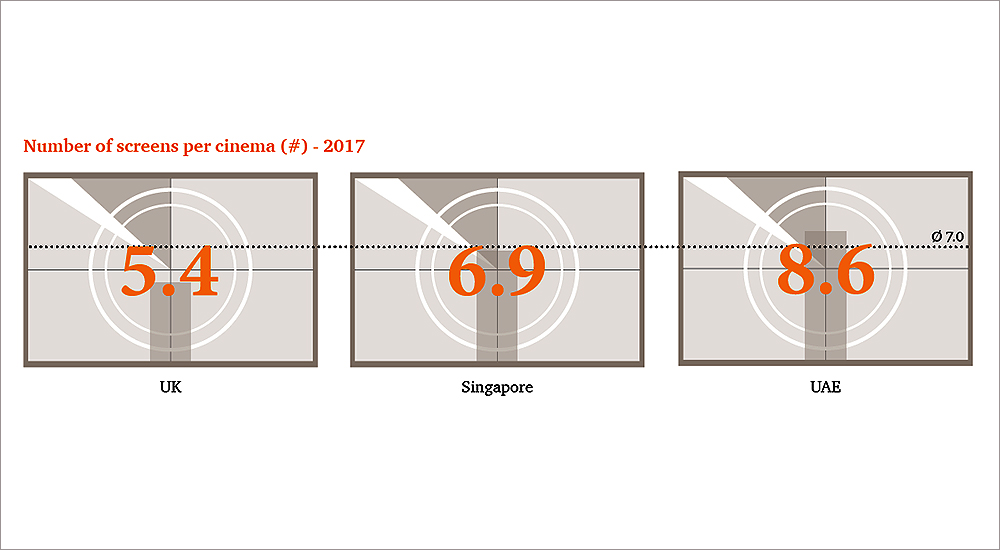

Market benchmarks indicate an average of 6.6 screens per 100,000 inhabitants in developed markets excluding USA and Canada, which have a highly penetrated cinema market. While UAE is at the lower end of benchmarks, the screen density has increased significantly from 3.6 in 2012 to 4.8 in 2017. With many new multiplexes expected to open in the UAE in the next few years, the screen density will also be closer to the average benchmark.

Depending on how rapidly Saudi Arabia’s market evolves, it could potentially generate 60 to 70 million admissions in 2030. PwC estimates Saudi Arabia’s cinema box office market could be $950 million in 2030. With non-admission F&B concessions and advertising typically comprising 35% of overall revenue, cinema industry has the potential to generate total revenue of $1.5 billion in 2030 and develop into a lucrative revenue stream for the industry players and the government.

As the cinema industry penetrates beyond the key cities and adopts several different formats 3D, IMAX, VIP, Kids, the prices are expected to vary a lot and could range from $11-14 at the lower end to $40 for high-end, luxury experiences.

Saudi Arabian residents have been known to travel to neighbouring countries such as the UAE and Bahrain to spend on entertainment. Increasing hospitality and cinemas within the country will help reverse this trend and inject recreational spend back into Saudi Arabia, stimulating the leisure sector.

Key takeaways

- Saudi Arabia’s market could generate 60 to 70 million admissions in 2030 depending on pace of development.

- Saudi Arabia’s cinema box office market could be $950 million in 2030 depending on pace of development.

- With Saudi Arabia’s population forecast to be 39.5 million by 2030, Saudi Arabia has the potential to absorb up to 2,600 screens.

- Content screened is expected to range from global Hollywood blockbusters to Bollywood, regional and local films.

- Lifting 35-year ban on cinema is one of most impactful initiatives undertaken by Saudi Arabia’s government.

Tips to succeed

Market players should consider several factors as a first-time entrant in Saudi Arabia’s cinema industry.

Location

- Securing good locations is imperative for cinemas to succeed.

- Cinemas are largely a catchment play and cinemas in mall areas with strong footfall are likely to witness higher returns.

Content

- Strong movie slate usually pulls audiences into cinemas.

- Mix of Hollywood, Bollywood and local content is likely to appeal to audiences with adaptation where required.

- Knowing your audience and effective programming can improve occupancies.

Formats

- Saudi Arabia has the opportunity to learn from global and regional markets and jump directly into successful cinema formats.

- Cinemas are evolving from vanilla movie-going into experiences and industry would need to cater for different tastes and preferences.

Pricing

- In the initial years, cinema demand is expected to far outstrip the supply.

- Industry players would need to adopt and experiment with different pricing models that are appealing to audiences.

- Pricing can be based on passes, time of day, day of week, seat configurations, types of screens.

Recent entrants

- Cinépolis, the fourth largest exhibition circuit in the world, and Al Tayer Group have partnered with Al Hokair Group and have been granted a Cinema Operating License.

- iPic Entertainment has signed a memorandum of agreement with BAS Global Investments Company to develop 25 to 30 sites over the next decade.

- Leading multiplex chain from India, PVR has signed an MoU with UAE based Al Futtaim Group for entry into Saudi Arabia and other regional markets.

- CJ 4DPLEX has signed a deal with Cinemacity to open 3x4DX locations in Riyadh.

- Kuwait National Cinema Company and Dubai based distributor Front Row Filmed Entertainment expect to develop 12 multiplexes in the next 3 years through their subsidiary Cinescape.

- Al Rashed Empire Cinema consortium has also received a license from GCAM.

Excerpted from Cinemas in Saudi Arabia: A billion Dollar opportunity by PwC.