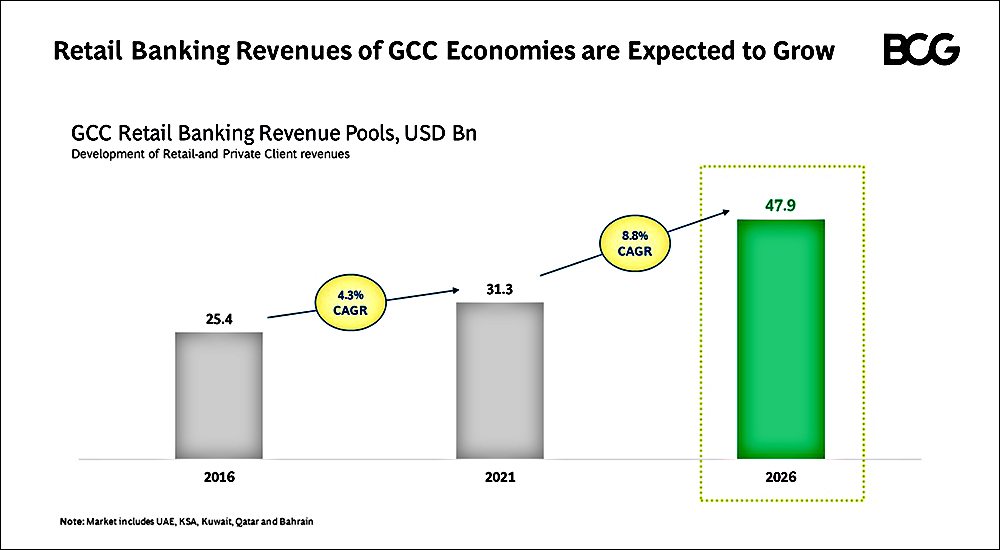

Retail banking revenues growing in UAE and GCC between 6% to 9% CAGR till 2026 forecasts BCG

The United Arab Emirates retail banking revenues are expected to grow at a CAGR of 6.4% between 2021 to 2026, a steep rise from 0.1% from 2016 to 2021. GCC economies, UAE, Saudi Arabia, Kuwait, Bahrain, and Qatar, expect to see an 8.8% CAGR within the same period to 2026, according to a new report by Boston Consulting Group (BCG).

The report, titled Global Retail Banking 2022: Sense and Sustainability, also reveals that one-quarter of retail banks surveyed globally report that ESG is a primary focus area for their digital transformation, and another 38% say that ESG is a key criterion in selecting and prioritizing digital transformation initiatives. In addition to ESG, through the five years from 2021 to 2026, payments, mortgages, and deposit products are likely to drive banking revenue growth in the GCC retail banking sector. An accelerated pace of digital payments and e-commerce adoption in the wake of COVID-19 will further benefit payment revenue growth.

Key Consumer Sentiments and Insights

- Increased trust in their bank during the COVID crisis than at the start of the pandemic in 2020. Customers want their banks to feel like a “good friend” that they can turn to for honest advice and a “school” where they can obtain financial guidance.

- When it comes to keeping personal data secure, customers trust their banks even more than their doctors. Furthermore, customers are willing to disclose more data to their banks if they value a new service or feature.

- Banks have many opportunities to innovate sustainable practices and products along the customer lifecycle and to practice good business in the process. Banks can also use the daily banking relationship as well as their personalized engagement capabilities to support customers in environmentally friendly and ethical living.

“Sustainability is rapidly reshaping competitive advantage, remaking whole industries, and generating new waves of growth. It has long been a part of good business—but in today’s evolving marketplace, engaging with customers and other stakeholders on ESG issues is a matter of rising urgency,” said Bhavya Kumar, Managing Director & Partner, BCG. “In addition to promoting sustainable behaviors by customers, banks can play an instrumental role in contributing to the UAE’s ambitious agenda for Sustainable Development. Through ESG-related products, banks can shape the sector and the country’s leap forward.”

“The UAE has deployed extensive efforts towards driving sustainability forward in the country under the framework and in alignment with the UAE Green Agenda 2015-2030. Retail banks have a critical role in contributing to the vision of the nation. To ensure continued success, banks must constantly strive to look to markets where they have unique advantages to create offerings and build business models to leverage these advantages.” said Martin Blechta, Principal, BCG. “ESG in banking is very much a credit portfolio review and there is a significant first mover’s advantage – whereby, banks that start this activity ahead of competitors have more choice to prioritize the right clients. As they consider a redirected future, retail banks must adapt to changing consumer preferences and utilize digital tools and technology to craft solutions that will fulfill customers’ needs in new and sustainable ways while advancing the overall ESG agenda.”