How Europe’s energy challenges are going to impact globally

Consumer discretionary stocks were part of the winners since the Great Financial Crisis, but with rising interest rates and soaring energy costs, the consumer is getting taxed on credit and available income for discretionary consumption. These dynamics will intensify and worsen over the winter period in Europe and several sell-side firms are already cutting price targets on many consumers’ discretionary stocks.

In our recent equity note, The tangible world is fighting back, we highlighted how intangibles-driven industry groups had outperformed significantly from April 2008 until October 2020. Consumer discretionary stocks were part of this megatrend, but the global energy crisis and especially here in Europe is going to be negative for consumer stocks going forward.

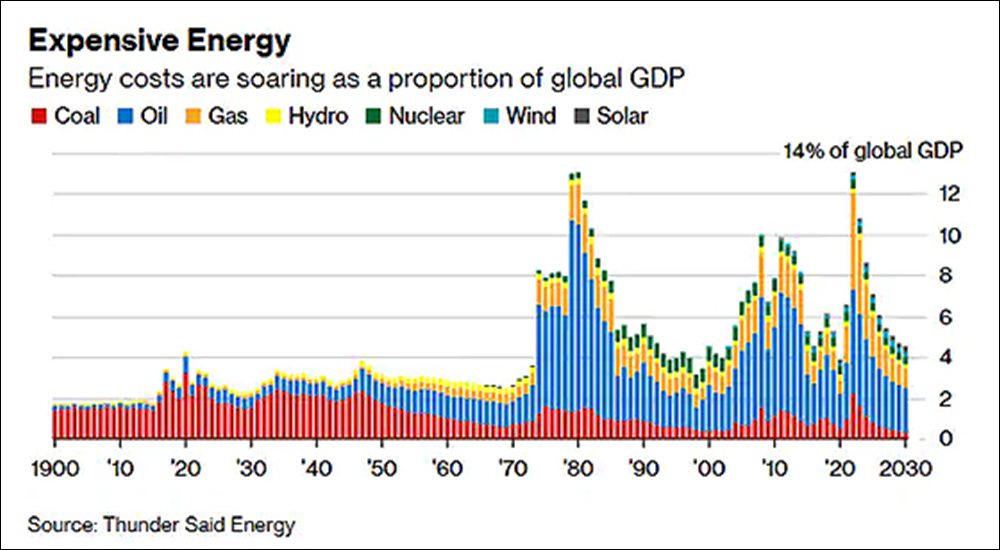

Primary energy costs in the percentage of global GDP have risen to 14% up from 6.5% in 2021 according to Thunder Said Energy. This is equivalent to a 7.5%-points tax on GDP which must be offset by households by cutting down on other things. The most vulnerable parts of the economy are the activities that sit at the very top of the Maslow pyramid, so things such as media and entertainment and consumer discretionary.

Global consumer discretionary stocks are down 13% after being down as much 20% in June this year relative to global equities since the peak in November 2021 when the Fed announced its pivot on monetary policy in the recognition that inflation was stickier than initially thought. The initial underperformance was interest rate driven as the higher interest rates caused equity valuations to decline.

Higher interest rates also impact consumption through consumer loans, but the critical point to understand is that the energy crisis has not been fully priced into consumer discretionary stocks. Consumer discretionary stocks have been one of the big winners since the Great Financial Crisis but with households under pressure we expect demand to cool dramatically, and several sell-side firms have drastically cut their price targets on many European consumer discretionary companies.

When talk about which consumer discretionary companies that could be in trouble the European luxury industry is probably going to be the hardest hit industry. Next after is the global car industry where the big open question is whether the EV adoption is strong enough to shield Tesla from the demand destruction.

The energy tax is bad for consumer stocks but good for global energy companies, so we have also highlighted the 10 largest energy companies in the lists below.

The 10 largest global consumer discretionary stocks

- Amazon

- Tesla

- LVMH

- Home Depot

- Alibaba

- Toyota

- McDonald’s

- Nike

- Meituan

- Hermes International

The 10 largest European consumer discretionary stocks

- LVMH

- Hermes International

- Christian Dior

- Volkswagen

- Inditex

- Essilor Luxottica

- Richemont

- Kering

- Mercedes-Benz

- BMW

The 10 largest global energy stocks

- Exxon Mobil

- Chevron

- Reliance Industries

- Shell

- ConocoPhillips

- Total Energies

- PetroChina

- Equinor

- BP

- Petrobras

Key takeaways

- Consumer stocks to be hit by historically high energy costs.

- Soaring energy costs are a massive tax on consumption.

- The energy tax is bad for consumer stocks but good for global energy companies.

- When talk about which consumer discretionary companies could be in trouble the European luxury industry is probably going to be the hardest hit industry.

- Next is the global car industry where the big open question is whether the EV adoption is strong enough to shield Tesla from the demand destruction.

Saxo Bank identifies the ten largest global and European discretionary stocks so investors can understand their exposure to the global energy crisis.